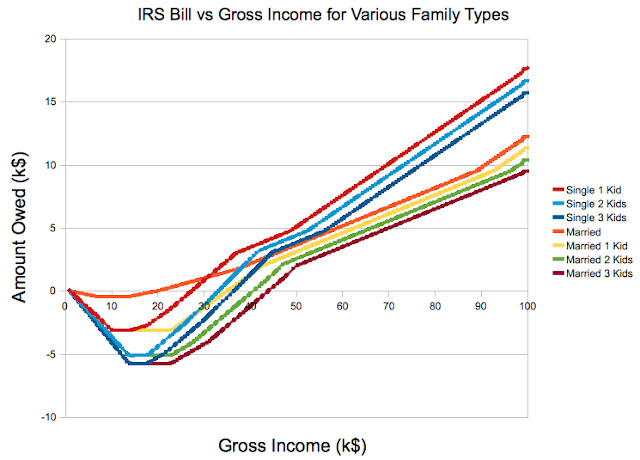

That's great and all, but now i'm really confused. Grad student stipends are low, but they're not that low. Lots of people make less than my family. Are they all paying negative taxes? Apparently they are. I wrote a quick chart to calculate tax burden for the various family types recognized by the EIC (single/married, 0/1/2/3+ kids). In this, i assume the family takes only standard deductions and the EIC, if applicable. Here is what i found. (All data are for 2011).

If there are three or more people in your household, you're making more than $30k before you start paying positive taxes. That describes 30% of the population! Medium to large families are making $45k-50k before the credit runs out, a statistic which describes most such families.

Growing up, i always thought the goal of taxation was to raise enough money to run the government without causing undue hardship to any one citizen. It seems Uncle Sam has taken a more pro-active approach. The above graph makes a little more sense if converted into units of poverty threshold for each family type. According to the Department of Health and Human Services, the household poverty threshold in 2011 was ($7070 + $3820/person)/year.

If you exclude childless households (who perhaps are less affected by shortages of food and shelter?), positive taxation cuts in at incomes of 1.5-1.9 times the poverty line. We shouldn't tax people who are truly living in poverty, but i'm a bit puzzled that the IRS thinks one third of the wealthiest nation on earth is too poor to support their own government. As someone living near that zero-taxes line i'm doing okay. I can imagine how an illness in the family or some other catastrophe could put a family like mine over the edge. But even so, i would think positive taxation should cut in at 1.0 times the poverty line. Doesn't 'poverty line' mean 'barely able to afford the essentials'? Once you have the essentials covered, shouldn't you be contributing something to the common good?

As weird as negative taxation is, it doesn't bother me too much at a gut level. What did bother me was the change in my tax

Maybe i'm missing the point here. The federal minimum wage in 2011 was $7.25/hr. A full-time minimum-wage job (40 hrs/wk, 50 wks/yr) would pay $14,500/yr. At that wage, the EIC is maxed out for everyone except the childless, who are already losing it. So the part of this law that makes sense is aimed at people who only have a part-time job. But you can't survive on a single part-time job and you certainly can't raise a family on one. So the target audience of the EIC is on welfare? Apparently there are 4.3 million people on welfare in this country and you can make up to $12,000/yr and still receive benefits. Since welfare pays substantially more than minimum wage in most states, perhaps the EIC is needed to encourage welfare recipients with children to at least get a part-time job? Again, this seems like a weird incentive structure to me. If someone can't hold down a full-time job, they should be on disability. If they can, then they don't need welfare beyond the safety net of unemployment insurance. As is, we're encouraging companies to offer part-time jobs at low wages in the knowledge that the government will chip in an extra 35-45%. This leaves otherwise full-time workers in a stable part-time limbo where adding hours results in a pay cut.

Am i missing something here? Selfishly, raising a family in grad school is difficult and i'm glad to have the money, but this policy seems really strange to me. What is it trying to accomplish?

No comments:

Post a Comment